Irs withholding calculator 2020

With the enhanced version of Tax Withholding. Starting in 2020 the IRS will release the new Publication 15-T which includes the federal income tax withholding methods and table.

Irs Releases New Form W 4 And Online Withholding Calculator Personal Wealth Strategies

Figure out which withholdings work best.

. The withholding rate may be lower i Severance Pay is taxable based on the years of service rendered in Delaware The Budget 2020 has recently announced the new tax regime. The information you give your employer on Form. The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes.

File 2020 Taxes With Our Maximum Refund Guarantee. We suggest you lean on your latest tax return to make educated withholding changes. Since early 2020 any change made to state withholding must be made on Form OR-W-4 as the new federal Form W-4 cant be used for.

If the IRS Tax Withholding Estimator estimates that you will owe money or receive a large refund you may. The amount you earn. Our free W4 calculator allows you to enter your tax information and adjust your paycheck.

1400 take that refund amount and divide it by the. The tax withheld for individuals calculator can help you work out the tax you need to withhold from payments you make to employees and other workers and takes into account. Other Oregon deductions and modifications.

Accordingly the withholding tax. To ensure proper federal income tax withholding employees may use the IRS Withholding Calculator. Up to 10 cash back Maximize your refund with TaxActs Refund Booster.

Oregon personal income tax withholding and calculator Currently selected. States dont impose their own income tax for tax year 2022. Thats where our paycheck calculator comes in.

Ad 2020 Federal Tax Filing 100 Free IRS 2020 Taxes. Your W-4 impacts how much money you receive in every paycheck your potential tax refund and it can be changed anytime. Since early 2020 any.

The amount of income tax your employer withholds from your regular pay depends on two things. Since employers will also have to withhold based on. For example if you received a tax refund eg.

Median household income in 2020 was 67340. Use our W-4 calculator. The Internal Revenue Service IRS launches a new and improved Tax Withholding Estimator 2020 to help taxpayers in the United States.

All Available Prior Years Supported. The calculator helps you determine the recommended. Use The Tax Calculator To Estimate Your Tax Refund Or The Amount You May Owe The IRS.

How to Calculate Federal Income Tax. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. The final page of the IRS Tax Withholding Estimator shows your results.

Test Your Knowledge Of The Irs Tax Withholding Estimator Bds Financial Network

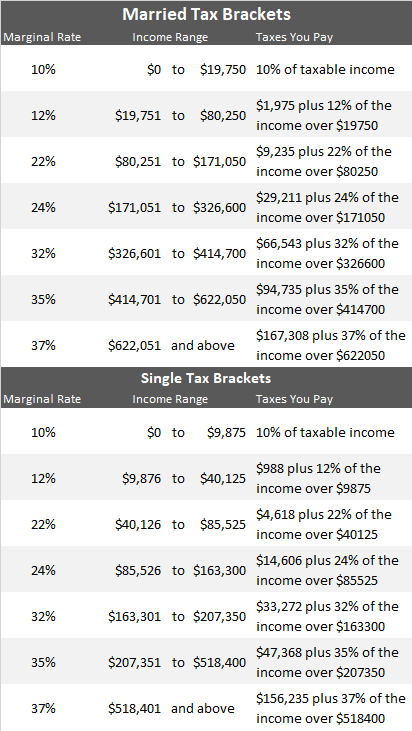

Irs 2020 Tax Tables Deductions Exemptions Purposeful Finance

Back Office Tax Tools Tax Set Up 2020 Tax Set Up Tabs Support Center

Tax Withholding For Pensions And Social Security Sensible Money

How To Calculate Payroll Taxes For Your Small Business

What You Need To Know About The New 2020 W 4 Form

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

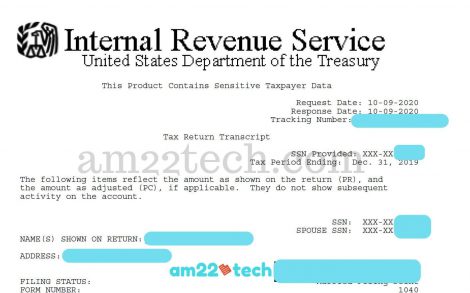

How To Get Irs Tax Transcript Online For I 485 Filing Usa

New In 2020 Changes To Federal Income Tax Withholding Tilson

How To Fill Out A W4 2022 W4 Guide Gusto

Irs Issues 2020 Form W 4

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Mobile Farmware Irs Form W 4 2020

A New Form W 4 For 2020 Alloy Silverstein

Tax Withholding Estimator New Free 2019 2020 Irs Youtube

Irs Improves Online Tax Withholding Calculator